AI model drift\~ when model performance degrades due to changes in data patterns\~ can lead to costly financial errors, compliance risks, and reputational damage. Real-time drift detection and adaptive retraining frameworks now define the frontier of financial AI governance, ensuring that machine learning models remain reliable, fair, and aligned with dynamic market realities.

Real-Time Insights: Strategies for Monitoring and Evaluating AI Model Drift in Finance

Real-Time Insights: Strategies for Monitoring and Evaluating AI Model Drift in Finance

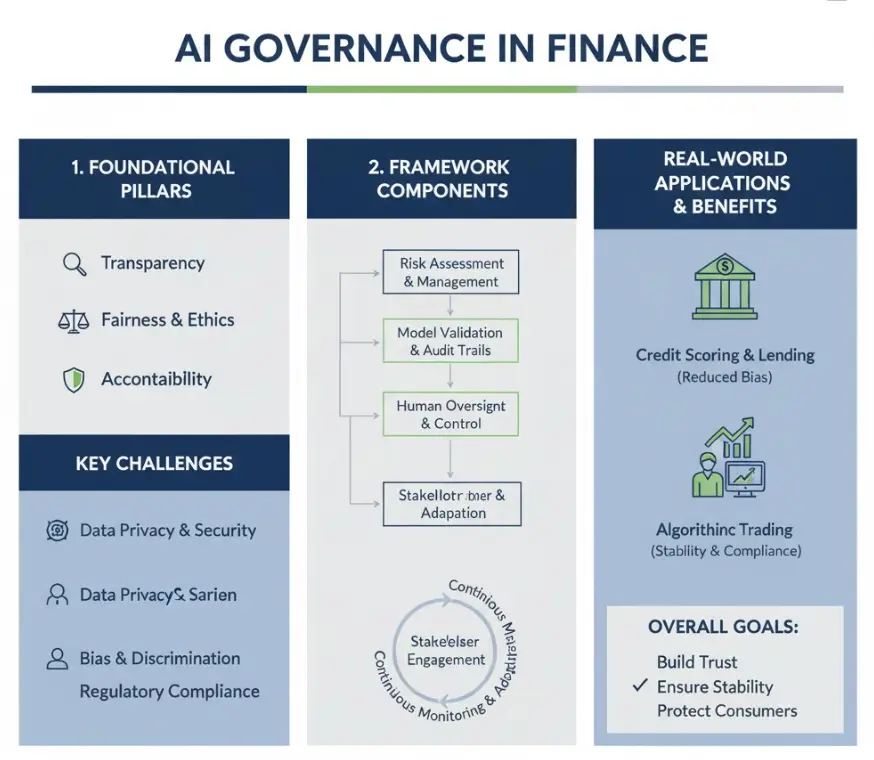

Understanding Model Drift in Financial AI Systems

Model drift occurs when a machine learning model’s input data distribution or target relationships shift over time. In finance, this can be triggered by macroeconomic volatility, consumer sentiment changes, or even evolving fraud tactics.

Common types of drift include:

- Data Drift: When input variables (e.g., transaction frequency, income levels) deviate from training data distributions.

- Concept Drift: When the relationship between inputs and outcomes changes; for example, what once indicated “low risk” may now signal “high risk.”

- Label Drift: When target labels (like “approved” vs. “declined” transactions) shift in meaning or balance.

Why Drift Matters in Finance

Unlike other industries, finance operates under stringent accuracy and compliance demands. Even minor performance decay can have large downstream effects. For instance:

- Credit scoring drift can lead to discriminatory lending outcomes.

- Trading algorithm drift can cause significant financial losses.

- Fraud detection drift can result in both false positives and missed fraud cases.

Regulatory bodies now emphasize explainability, accountability, and continuous monitoring~ making real-time drift management not just a best practice, but a necessity.

How Real-Time Drift Monitoring Works

Modern financial institutions employ a multi-layered approach to detect and respond to drift.

- Baseline Monitoring: Continuous comparison of live data distributions with baseline training data using metrics like Population Stability Index (PSI) or Kullback-Leibler (KL) divergence.

- Performance Auditing: Tracking shifts in model accuracy, recall, or AUC on streaming data to detect early degradation.

- Alerting & Root-Cause Analysis: When drift thresholds are exceeded, alerts are triggered for data scientists to inspect possible causes~ such as market shocks or feature correlations.

- Automated Retraining Pipelines: Integrating drift detection with retraining workflows ensures that models are regularly refreshed with up-to-date data without manual intervention.

Beyond 2025: Smarter and Safer Financial AI

The next phase of AI governance in finance will focus on proactive resilience rather than reactive maintenance. Key directions include:

- Adaptive Learning Systems: Models that self-correct and retrain on new market data in near real-time.

- Federated Drift Detection: Secure, cross-institutional collaboration to detect systemic drift without sharing sensitive data.

- Regulatory-Integrated AI Ops: Embedding compliance rules directly into model monitoring pipelines for automated reporting and audit readiness.

- Explainable Drift Diagnostics: Using LLM-based interpreters to explain why drift occurred and how to fix it, improving trust across both technical and regulatory teams.

How Abaka AI Supports Model Drift Monitoring

At Abaka AI, we enable financial institutions to detect and mitigate model drift through high-quality, time-stamped, and domain-curated datasets. Our data curation services ensure your retraining pipelines use data that’s not only recent- but also balanced, diverse, and regulatory-aligned.

We also offer evaluation frameworks for:

- Benchmarking drift resilience across model versions.

- Simulating stress-test scenarios for regulatory audits.

- Curating specialized datasets for adaptive retraining workflows.

With Abaka AI, you gain the foundation for models that evolve as fast as the markets they serve~ staying accurate, ethical, and audit-ready.

Get Started Today

In finance, AI drift isn’t just a technical problem~ it’s a risk management challenge. The difference between trust and uncertainty lies in the data and monitoring strategies behind your models.

📩 Contact Abaka AI today to learn how our real-time data curation and evaluation tools can help your models stay adaptive, compliant, and future-proof.

Let’s shape the future of financial AI~ reliable, responsible, and ready for real-time change. ⚡️