AI adoption across the Fortune 500 is no longer the bottleneck—scaling is. While most large enterprises now run multiple AI pilots, only a small subset are successfully turning them into production-grade systems that compound value over time. The difference is not model access, but data readiness, evaluation rigor, human review, and governance. As enterprises move from experimentation to core deployment, the winners will be those that build repeatable AI operating systems rather than collections of isolated pilots—where Abaka AI supports this transition through workflow-grounded datasets, evaluation frameworks, and deployment-ready data pipelines.

Enterprise AI in the Fortune 500: Moving from Pilots to Production

Understanding the Fortune 500 AI Landscape — How Abaka AI Can Support the Growing Interest in Adopting AI & Move to Production

.webp)

Over the last 18-24 months, AI inside the Fortune 500 has shifted from "experimentation at the edges" to "deployment pressure at the core." Most large companies now have multiple AI initiatives running at once — customer support copilots, developer tooling, demand forecasting, fraud detection, knowledge search, and document automation — yet many are still struggling to translate pilots into a durable operating advantage. Outside of commercial deployment, the use of AI and agentic capabilities could contribute significantly to internal workflows within the operations or accounting spaces.

The article outlines the recent trends amongst companies/sectors within the Fortune 500 companies, and then explains how we at Abaka AI can support each sector's recent AI initiative. This comes in the form of OTS datasets (tailored specifically to each industry's demand and area of business development), annotation/labeling, collection, and evaluation/benchmarking. Beyond Abaka's support, this article summarizes the common blockers (data, governance, evaluation) that separate AI pilots from AI systems that compound value over time.

The New Baseline: AI is Everywhere, but "Scaling" is the Differentiator

From our recent analysis, two macro signals define the current landscape:

A. Enterprise AI usage is not mainstream, but uneven in "domain applications" comprehension.

Stanford's 2025 AI Index reports 78% of organizations used AI in 2024, up from 55% the prior year. That doesn't mean every Fortune 500 firm is "AI-native," but it does mean AI is no longer a niche capability confined to tech and quant teams.

B. The conversation is shifting from "capability" --> "risk + governance + ROI."

McKinsey's 2025 State of AI emphasizes that many organizations still face "pilot-to-scale" friction, and that AI high performers differentiate themselves through management practices across strategy, talent, operating model, technology, data, and adoption/scaling.

At the same time, public-company disclosures show risk awareness rising: by Aug 15, 2025, ~72% of S&P 500 filers in one analysis disclosed at least one material AI-related risk (with strong variation by industry).

(While this is the S&P 500, it's a close proxy for large-cap enterprise behavior.)

Five Trends Showing Up Across Fortune 500 Industries:

Trend 1 → Copilots move from novelty to workflow redesign

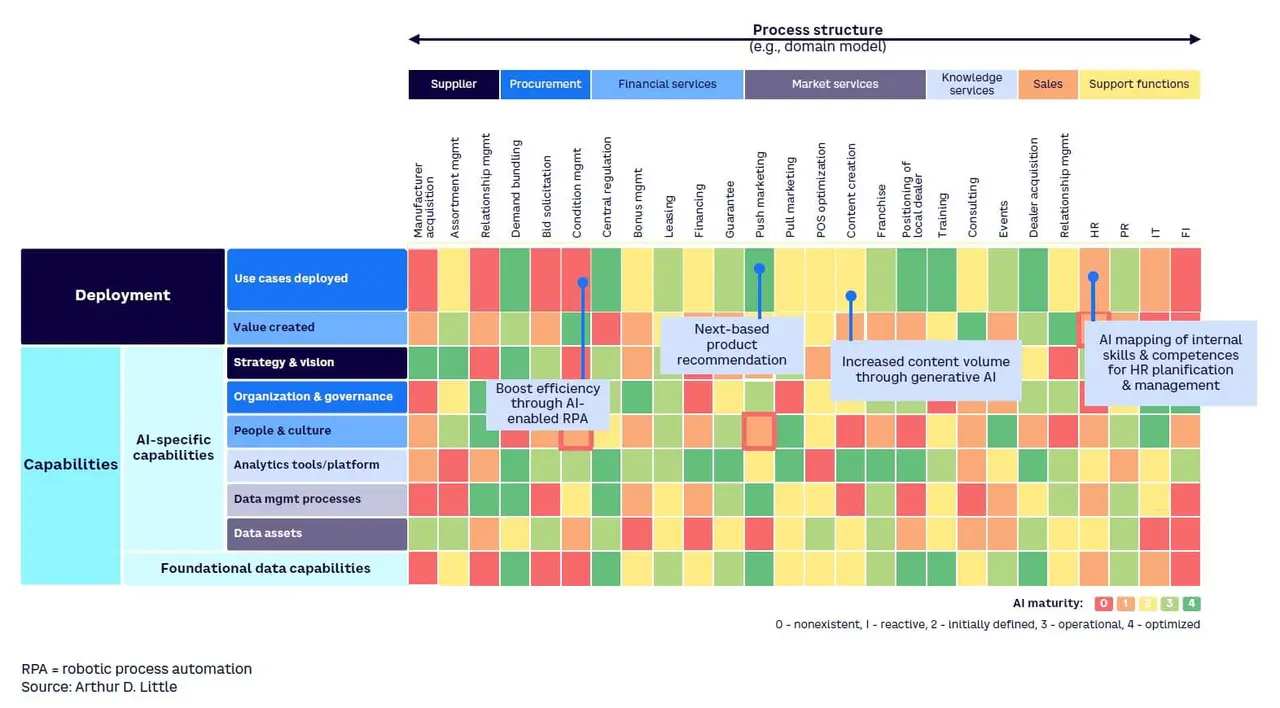

- A growing share of value is coming from embedding AI into specific workflows (claims handling, procurement, underwriting, maintenance, and close process), not from generic chat interfaces. This aligns with the broader "rewiring" theme emphasized in McKinsey's 2025 findings.

Trend 2 → AI "risk language" becomes standard in boardrooms and filings

- The rapid rise in AI risk disclosures signals that governance is no longer optional, especially around privacy, IP hallucinations, cybersecurity, regulatory exposure, and model accountability.

- AI risk language refers to how companies systematically identify, describe, and govern the legal, financial, operational, and reputational risks created by AI systems. This is similar to how cybersecurity or data-privacy risks are discussed today.

Trend 3 → Agentic AI is the next frontier (but hard to operationalize)

- Deloitte has recently predicted that there will be an increasing enterprise focus on AI agents (systems that take actions, not just generate text), which raises the stakes for evaluation, permissions, and auditability. Gartner's 2025 AI Hype Cycle also elevates areas like AI TRiSM (trust, risk, security management) and multimodal AI as major themes.

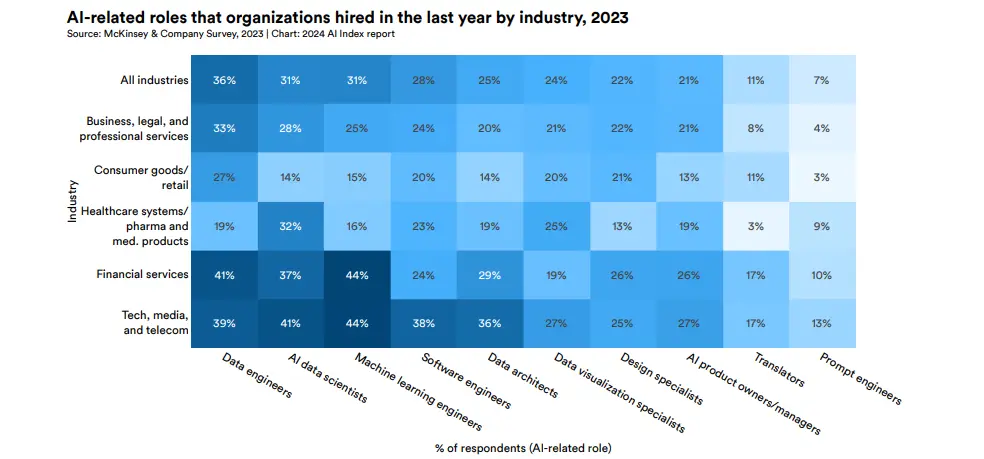

Trend 4 → Data Advantage > Model Advantage

- Model quality is improving, and the performance gap is tightening, meaning competitive advantage increasingly comes from proprietary data + feedback loops + evaluation rather than "which base model you picked." (Stanford notes that performance gaps are shrinking, alongside accelerating investment and adoption into scrutinized and viable methods of data collection and preparation.)

Trend 5 → Employee adoption is rising, creating "Shadow AI" risk

- Worker usage is increasing quickly (especially knowledge work), which is great for productivity, but creates governance and data leakage risks if unmanaged.

Industry by Industry: How AI Adoption Looks Across the Fortune 500

A practical "industry map" of where AI is most mature, where it's accelerating, and what's holding it back.

Internally:

Sector Specific:

A. Financial Services (Banks, Insurance, Payments)

- Most mature domains: fraud/anti-money laundering, credit risk, collections, call center automation, document intelligence, and personalization.

- GenAI acceleration: customer service copilots, analyst copilots (research + memo drafting), code assistants, internal knowledge search.

- Key blockers: model risk management, explainability expectations, strict privacy requirements, vendor risk, regulatory scrutiny, and audit trails.

B. Healthcare & Life Sciences (Providers, Pharma, MedTech)

- Most mature domains: clinical documentation, revenue cycle automation, trial optimization, safety signal detection, supply chain.

- GenAI acceleration: huge upside, but the highest bar for safety, validation, and governance.

- Key blockers: Protected Health Information constraints, regulatory posture, integration into clinician workflows, and evaluation on real-world edge cases.

C. Retail & CPG

- Most mature domains: demand forecasting, inventory optimization, personalized marketing, customer support automation, product content generation.

- GenAI acceleration: creative + merchandising operations (faster content variation, localization, catalog enrichment).

- Key blockers: data fragmentation across channels, brittle product hierarchies, and measuring incremental lift cleanly. Essentially, a lot of demand data is noisy, customer signals are hard to amalgamate, and sales processes are difficult to analyze.

D. Industrial, Manufacturing, & Automotive

- Most mature domains: predictive maintenance, quality inspection (vision), process optimization, engineering knowledge search, procurement analytics.

- GenAI acceleration: maintenance copilots (SOP + troubleshooting), engineering documentation copilots, code assistants for embedded/controls.

- Key blockers: OT/IT integration, sensor data quality, long deployment cycles, safety-critical constraints.

E. Technology & Enterprise Saas:

- Most mature domains: most mature adopters, with AI embedded across developer tooling, internal platforms, and customer-facing products.

- Key blockers: evaluation of agentic behavior, regression testing across codebases, and preventing hallucinations in internal tools.

The Common Failure Modes: Why Many Fortune 500 AI Programs are Stalling

Even with sufficient budgetary and leadership support, the same issues repeat across each industry

A. Data is not "model-ready."

Enterprises often lack sufficiently clean, permissioned, labeled, and lineage-tracked data to customize and evaluate systems reliably (and many teams hit proprietary data constraints when trying to tune or ground models).

B. Evaluation is underbuilt → The rest of the construction needs to be carefully completed.

Teams demo well in a sandbox but fail in production because they lack:

- Realistic task suites

- Regression tests for workflows

- Human review standards

- Monitoring for drift/hallucination

- A Feedback loop that improves over time

C. Governance arrives late.

AI TRiSM and similar styles concerns (trust, risk, security) often show up only after shadow usage spreads or after legal/security blocks deployments, yet public disclosures suggest these risks are now squarely on leadership agendas.

Where Abaka AI fits: Turning Enterprise Reality into High-Quality AI Systems

Abaka AI's value in the Fortune 500 landscape is straightforward: data, evaluation, and deployment readiness. The winners across industries are building repeatable pipelines, not one-off prototypes. As Fortune 500 companies progress from isolated pilots to production-grade, governed AI systems, the limiting factor is rarely access to models. Instead, it is data readiness, evaluation rigor, human review, and governance alignment. Abaka Ai is designed to support each industry at precisely these pressure points.

A. Dataset creation that reflects real enterprise workflows

We help teams create high-quality/signal datasets for all industries/sectors. Specifically for the Fortune 500 workflows:

- Document and claims workflows (financial services, insurance, healthcare admin)

- Supply chain and procurement processes

- Customer support and knowledge bases

- Developer productivity and internal tooling

B. Human-in-the-loop review to produce trustworthy ground truth

Enterprise AI often fails in edge cases. Human review, combined with a clear rubric design, is what transforms "AI that sounds right" into "AI that is right."

C. Synthetic + annotated data where proprietary data is limited:

When sensitive data can't be widely shared internally (or labeled cheaply), synthetic data and structured augmentation, done carefully, can expand coverage while respecting privacy/security constraints (which aligns with how many enterprises are thinking about proprietary data limits).

D. Evaluation harnesses that behave like production

Instead of generic benchmarks, we build task suites that mirror:

- Your documents

- Your policies

- Your failure modes

- Your compliance requirements

- Your definition of "done"

E. Industry Support: Adopting AI

**Industry-specific [boiled down] services. In reality, Abaka AI provides comprehensive data solutions that go beyond the abbreviated description.

Tech & Enterprise Saas

- High-quality coding and workflow datasets grounded in real enterprise environments.

Banking & Financial Services

- Curated datasets for document-heavy workflows (claims, KYC, compliance), data annotation (ops or finance), and evaluation pipelines that surface failure modes before production exposure.

Retail & Consumer Packaged Goods (CFG)

- Structured datasets for demand planning and merchandising workflows, and synthetic data augmentation for long-tail scenarios.

Logistics & Supply Chain

- Workflow-specific datasets for exception handling, scenario-based evaluation using synthetic & historical disruptions, and Feedback loops.

Industrial & Manufacturing

- Dataset construction from real maintenance and QA events, Evaluation environments aligned to safety and reliability thresholds.

Healthcare & Life Sciences

- Secure, privacy-preserving dataset pipelines, Human review for clinical and RCM use cases, and evaluation framework for safety and explainability.

F. From Hype to Governance: Where Abaka AI fits in

- Pilots → Copilots: provide realistic datasets to human-revised ground truth

- Copilots → Production: build evaluation, regression testing, and feedback loops

- Production → Scale: support governance, risk management, and continuous development

Abaka supports organizations across every stage of this transition—providing the datasets, evaluation frameworks, annotation, and human review needed to move from hype driven experimentation to governed production-grade AI systems.

Closing: What "AI Leadership" Will Mean in 2026 for the Fortune 500

By 2026, the Fortune 500 won't be divided into "AI companies" and "non-AI companies." It will be divided into:

- Companies with repeatable AI operating systems (data + evaluation + governance + workflow integration)

- Companies with a collection of pilots

The data suggests adoption is broadening rapidly, but a durable advantage comes from how well organizations operationalize trust, risk, and real-world performance, not from experimentation alone.